DF Automation & Robotics Driving the Future of Robotics

- RM 4,038,216135% of the Min.Target (RM 3,002,460)

- 110Investors

- RM 773,640Largest Investment

- 6 Apr 2024Cooling Off Period End Date

This campaign was successfully funded on 31 Mar 2024.

- Equity - OS

- ~ up to 9.09%

- RM 80,006,165

- RM 3,002,460

- RM 8,001,648

- -

- DF Automation & Robotics Sdn Bhd

- 5, Jalan Impian Emas 18, Taman Impian Emas, 81300 Skudai, Johor, Malaysia.

- 1006594V

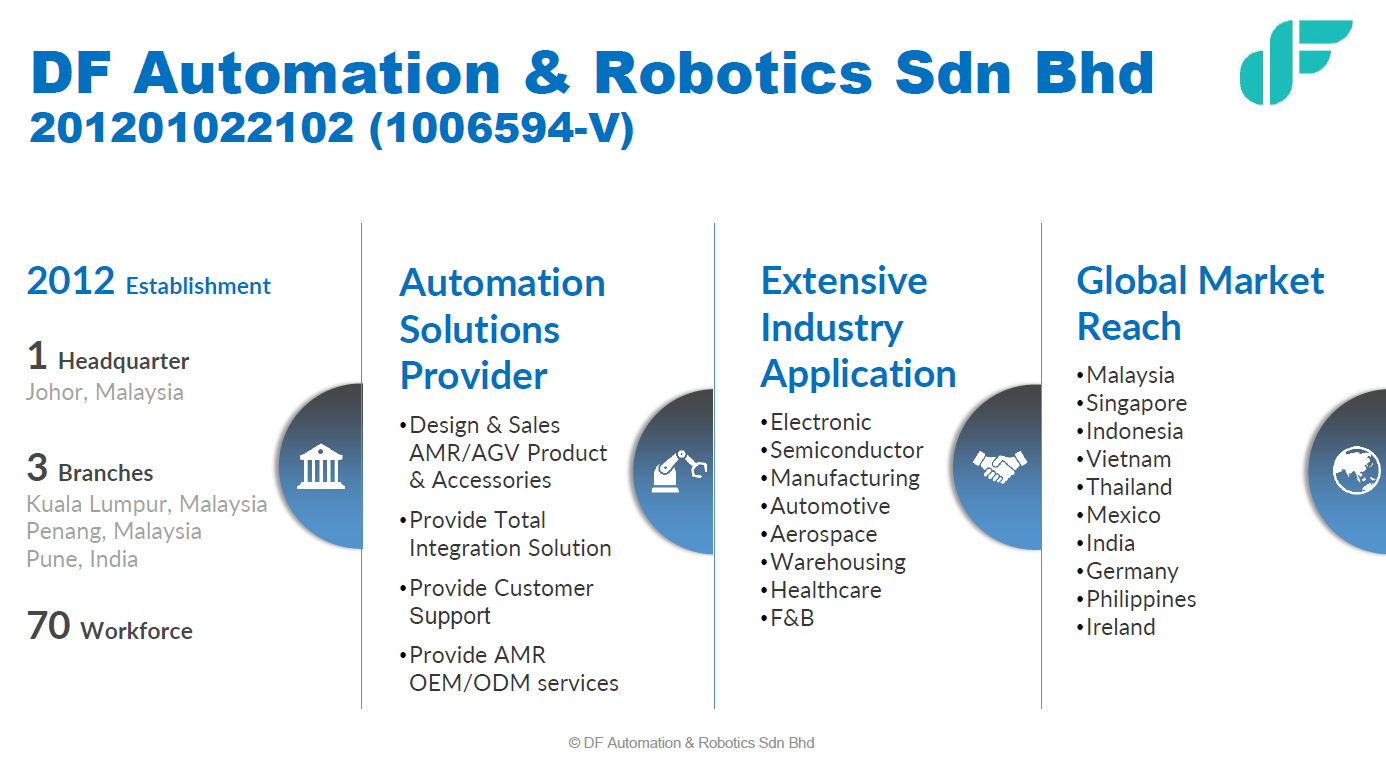

- DF has served more than 50 MNCs companies in 10 countries.

- DF has 18 IPs, having developed the autonomous mobile robot, both software and hardware, all in-house in Johor Bahru.

- DF is serving diverse industries, including E&E, 3C, semicon, warehouse, F&B, and automotive, among others.

- DF is one of the leading robotic companies in Malaysia, if not in Southeast Asia.

Summary

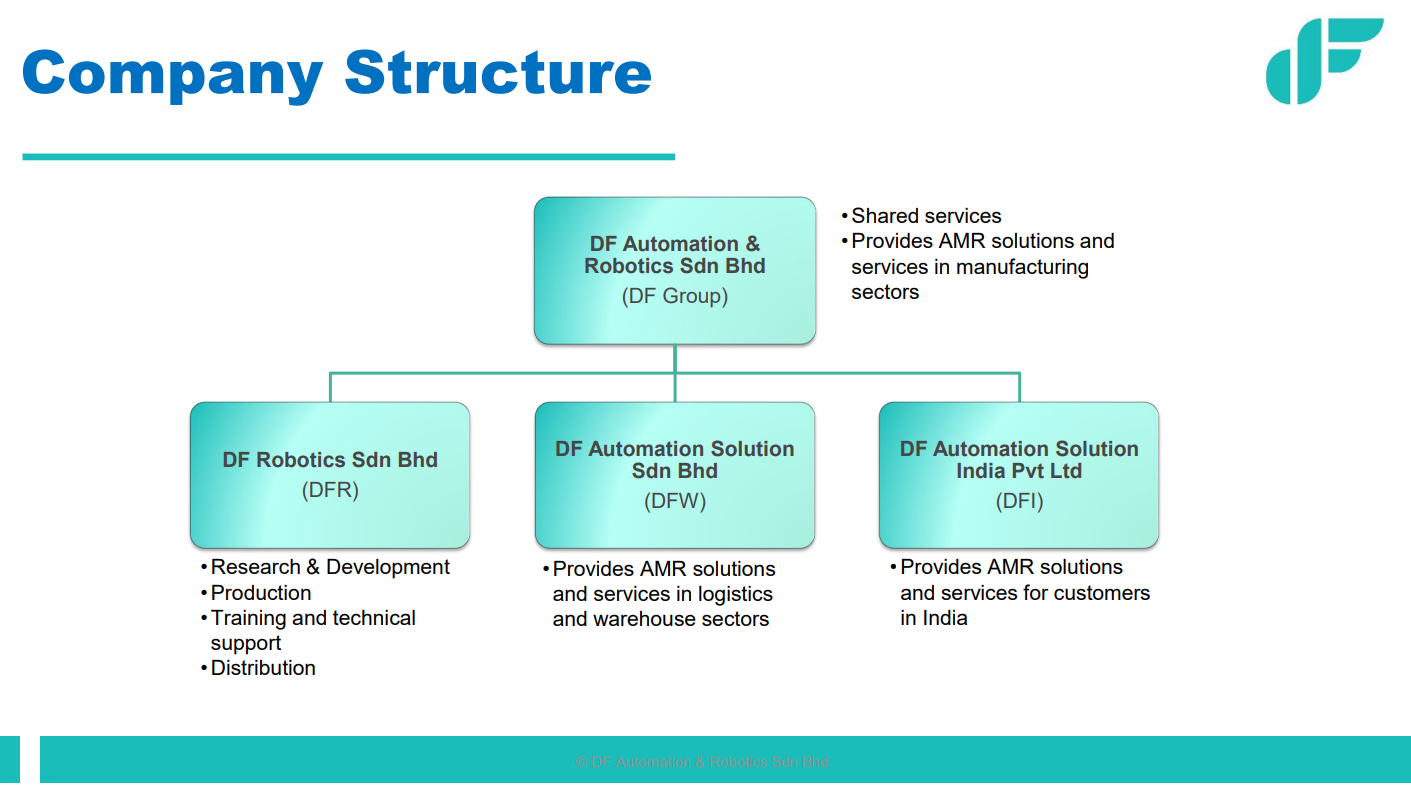

DF Automation & Robotics (DF) is a technology company specializing in designing, manufacturing, servicing, marketing, and providing Autonomous Mobile Robot (AMR) systems for various industrial and commercial uses.

Problem

In manufacturing industries, many goods/items need to be transported. Currently, most businesses relying on manual labor to transport loads between locations face several challenges.

Firstly, these tasks are mundane and repetitive, often leading to worker fatigue and decreased morale. Over time, this can result in higher turnover rates, with companies constantly needing to hire and train new employees.

Secondly, manually transporting heavy or hazardous materials poses significant safety risks. Workers are vulnerable to injuries, from strains and sprains to more severe accidents, especially when carrying hefty loads over long distances or through challenging terrains. Such incidents not only affect the employee's well-being but also lead to increased medical expenses, potential legal liabilities, and downtime in operations.

Lastly, manual load transportation is often less efficient compared to automated or semi-automated solutions. Humans have physical limitations on the weight they can carry and the speed at which they can move. As a result, businesses might experience delays, inconsistent throughput, and a general reduction in operational efficiency.

Incorporating tools or systems to alleviate these issues, such as autonomous mobile robots, can be a game-changer for many companies, enhancing productivity while ensuring worker safety.

Solution

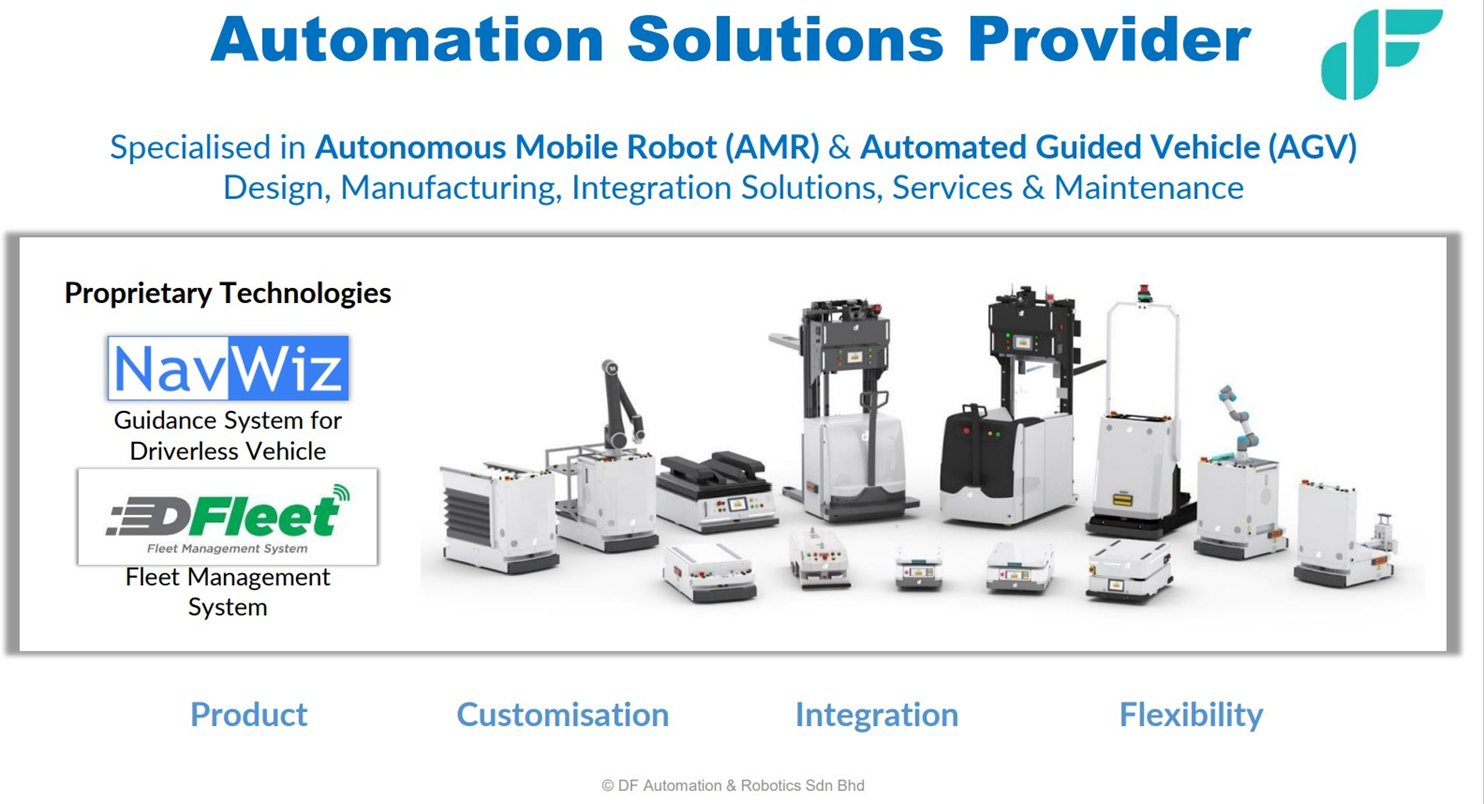

DF designs and manufactures Autonomous Mobile Robots (AMR) for industries.

An AMR is a mobile robot that can navigate autonomously and perform tasks in various environments without human intervention. AMRs use sensors, cameras, and onboard algorithms to perceive their environment and choose their paths.:

AMRs are perfectly suited for repetitive tasks such as transporting materials. By automating these mundane jobs, workers can be redeployed to more value-added tasks, increasing overall job satisfaction and reducing turnover.

AMRs are equipped with advanced sensors that allow them to detect obstacles, avoid collisions, and safely navigate through their environments. This reduces the risk of accidents associated with manual transportation of heavy or hazardous materials. Moreover, by automating the transport of heavy loads, the risk of physical injuries to workers, such as strains or sprains, is significantly reduced.

AMRs can operate continuously, without breaks, and at a consistent pace. Their precision and reliability can lead to increased operational throughput. Additionally, their ability to autonomously determine the best route ensures optimal efficiency in material transportation, especially in dynamic environments where obstacles or operational layouts might change.

In essence, AMRs offer businesses an opportunity to increase safety, efficiency, and productivity. They can seamlessly integrate into existing operations, adapt to changes, and deliver consistent performance, making them a valuable asset in modern-day logistics and manufacturing environments.

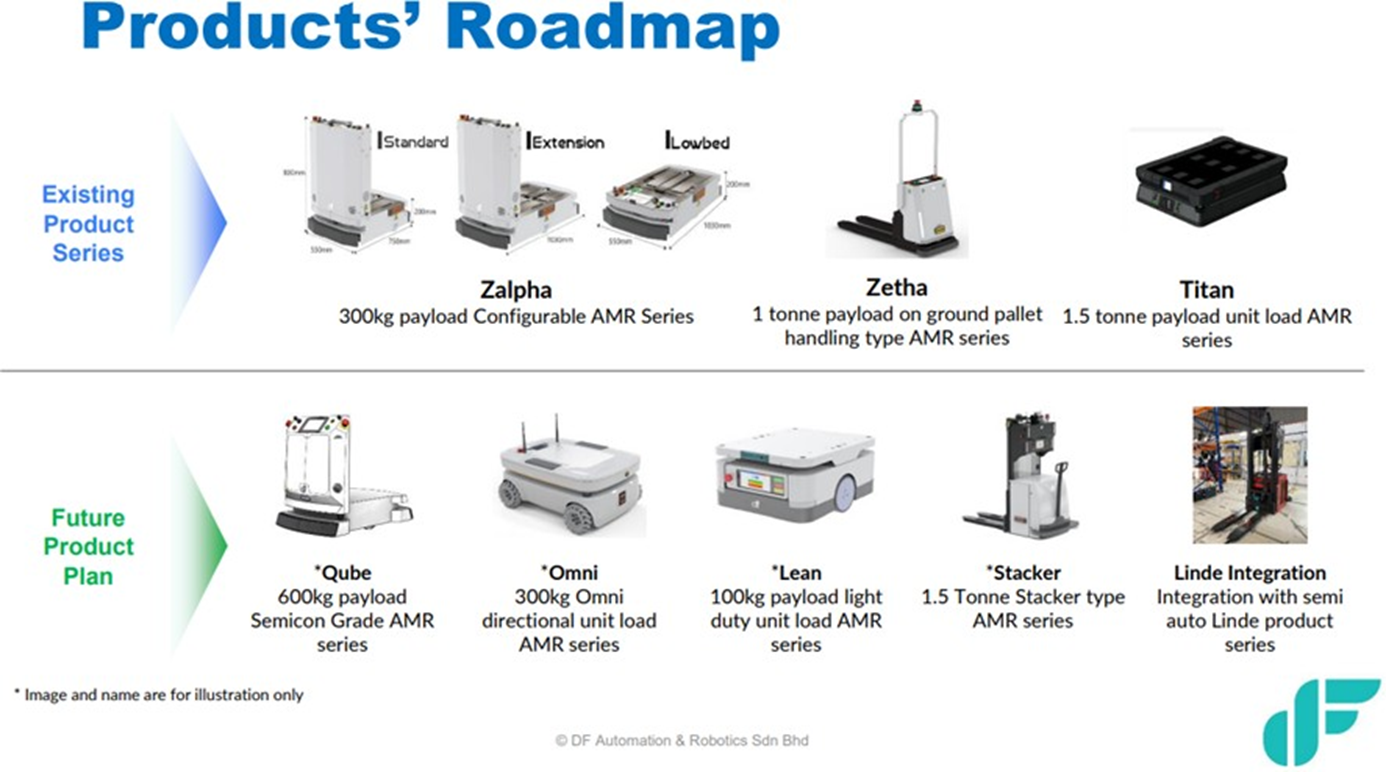

Product

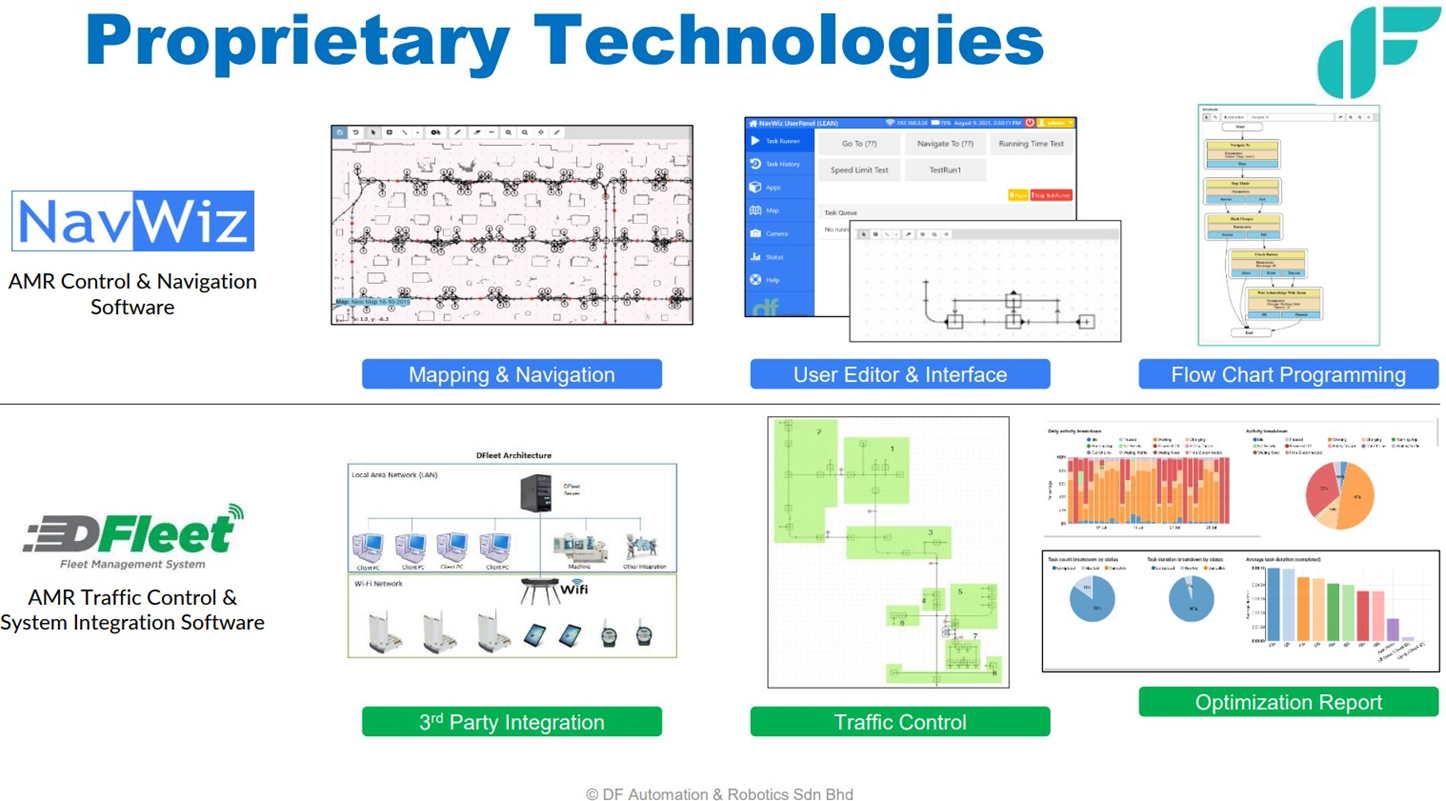

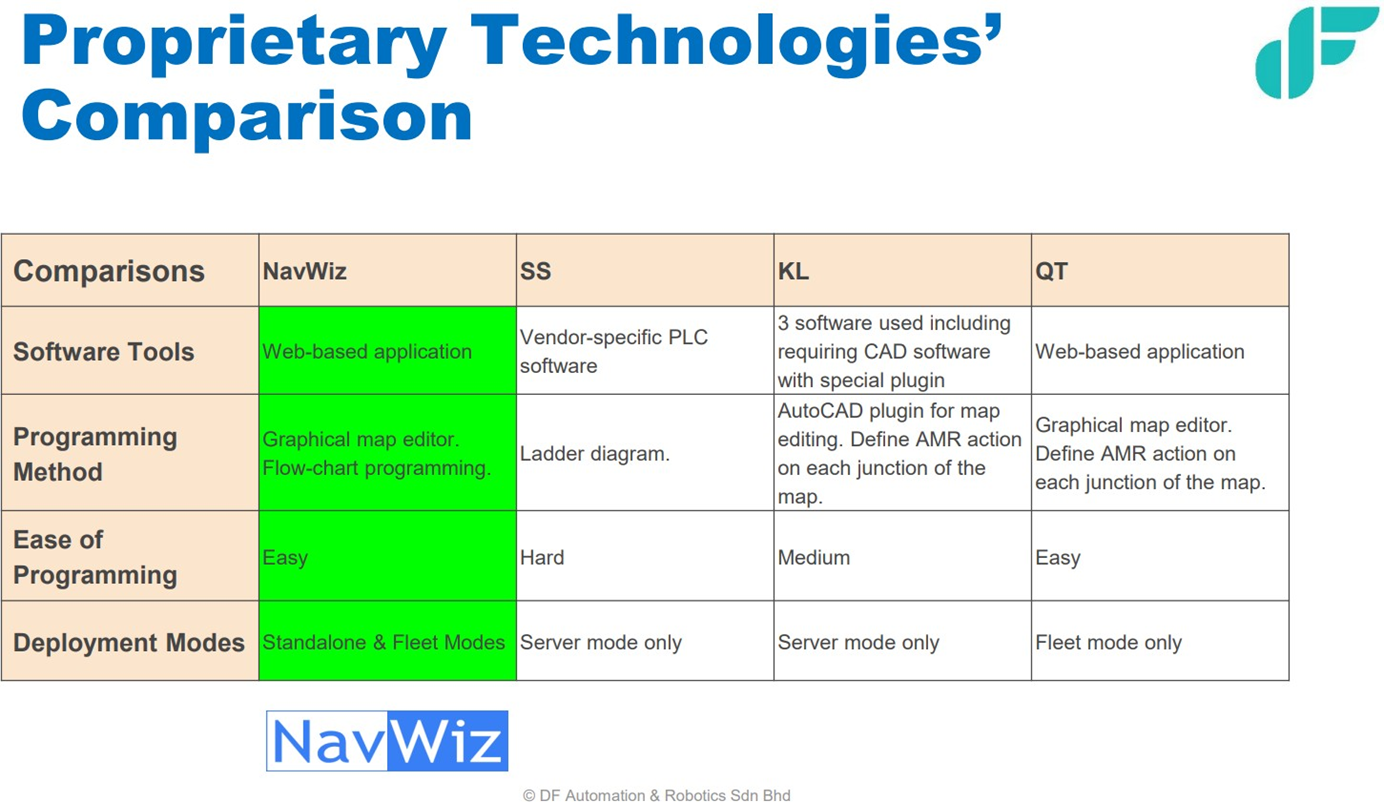

DF designs and develops the whole autonomous mobile robot (AMR) system. Two important software are NavWiz and DFleet. Both are the core technology to empower all DF’s AMR.

NavWiz is a web-based programming software to program AMR to move autonomously. NavWiz is easy to use and industry 4.0 enabled where it can easily communicate with other machines and facilities. NavWiz is like the brain of robots.

DFleet is a fleet management system to manage fleets of AMRs running in a factory. It’s important in traffic control and scheduling to ensure all the AMRs work together seamlessly.

Traction

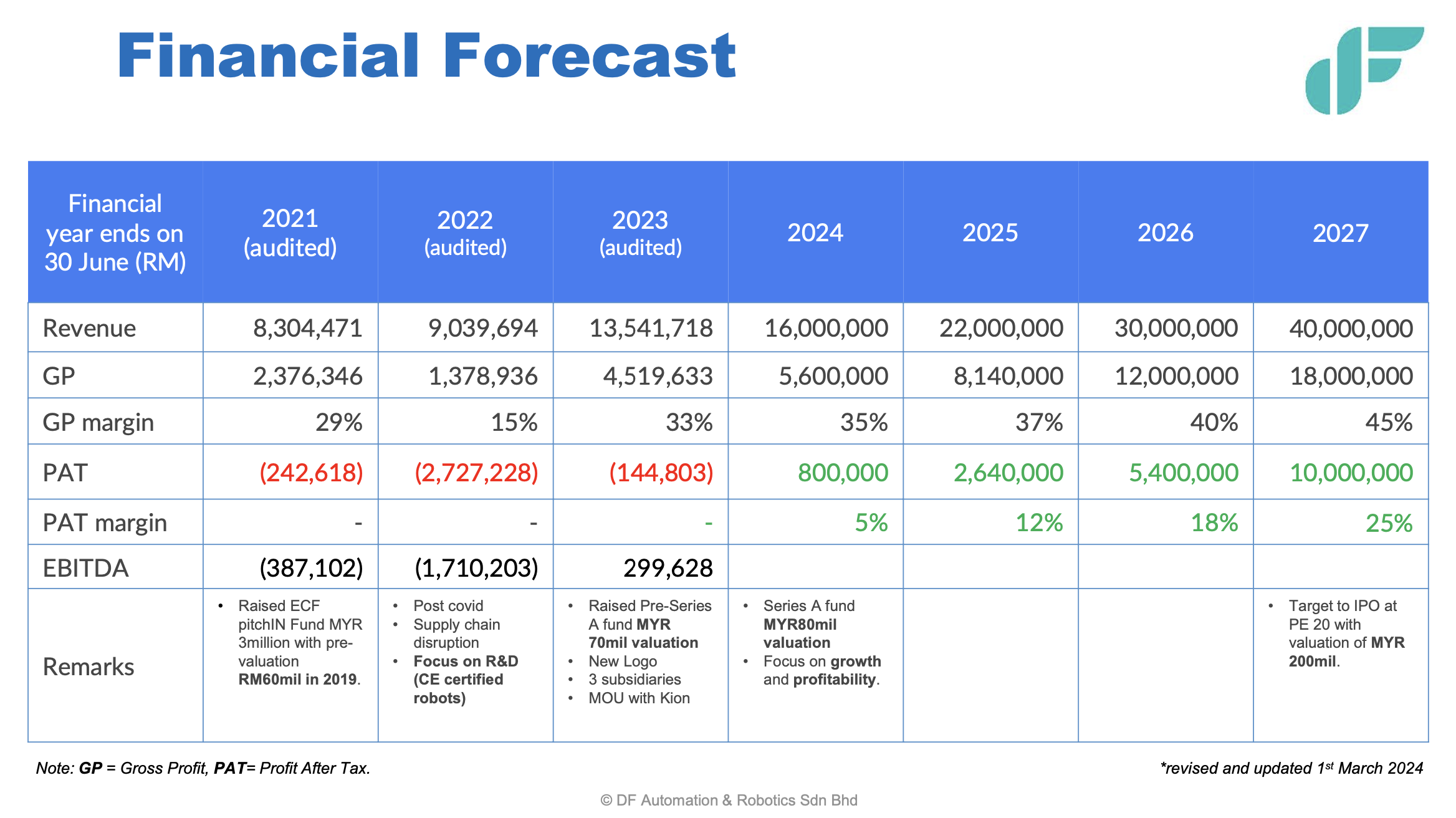

DF was profitable before COVID. However, our business was adversely affected during the Movement Control Order (MCO) in 2020. Despite a slight loss, we began recovering in 2021 with revenue reaching RM8.3 million. Subsequently, our revenue grew further in 2022, totaling RM9.0 million. However, we encountered a deficit of RM2.7 million due to substantial expenses incurred that year for Research and Development (R&D) on a new product (Zetha AMR for warehouse usage), which we did not capitalize.

DF was profitable before COVID. However, our business was adversely affected during the Movement Control Order (MCO) in 2020. Despite a slight loss, we began recovering in 2021 with revenue reaching RM8.3 million. Subsequently, our revenue grew further in 2022, totaling RM9.0 million. However, we encountered a deficit of RM2.7 million due to substantial expenses incurred that year for Research and Development (R&D) on a new product (Zetha AMR for warehouse usage), which we did not capitalize.

In addition, the supply chain disruption during that period led to a price spike and delivery issues, causing further losses. On a positive note, we successfully introduced a new robot model, Zetha, designed for warehouse use, and commenced its commercialization, including export to India.

By 2023, our revenue had increased to RM13.5 million, although we experienced a slight loss. For the financial year 2024, we project revenue to reach RM16 million, with a Profit After Tax (PAT) of approximately RM800,000. Looking ahead, we aim to achieve a revenue milestone of RM40 million in 2027, accompanied by a RM10 million PAT. This growth strategy aligns with our plan to list on Bursa, targeting a Price to Earnings (PE) ratio of 20 and a valuation of RM200 million.

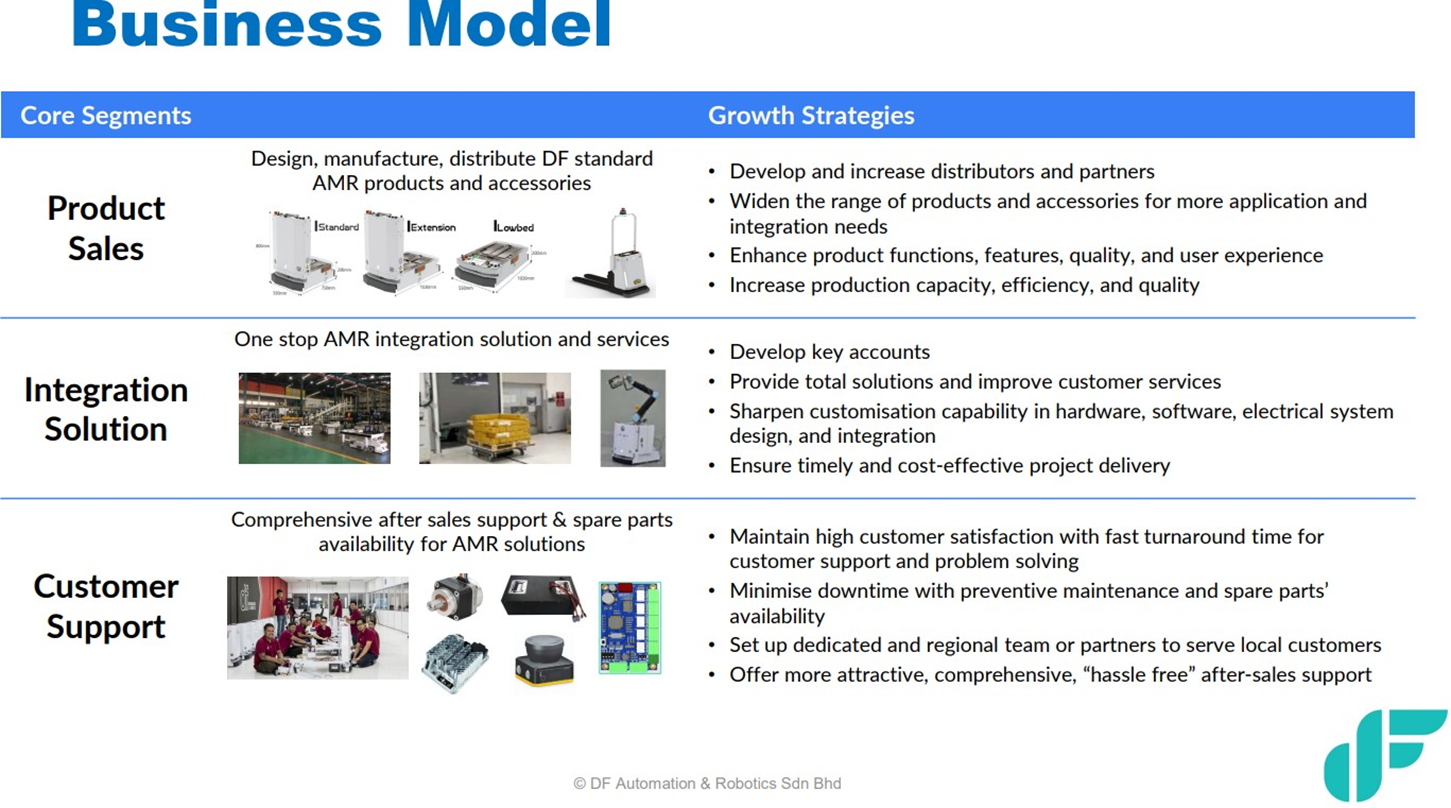

To attain positive PAT, we have devised various strategies, including a focus on high-value key industries such as semiconductors, warehouse, and electronics. We also plan to target key markets in South East Asia, India, and Europe, outsource non-core business activities to strategic partners, and prioritize after-sale support.

Customers

Our main customers are in Electronics Manufacturing Services (EMS), Computers, Consumer Electronics and Communication (3C), Warehouses, Semiconductors, and Automotive sectors.

Business Model

Market

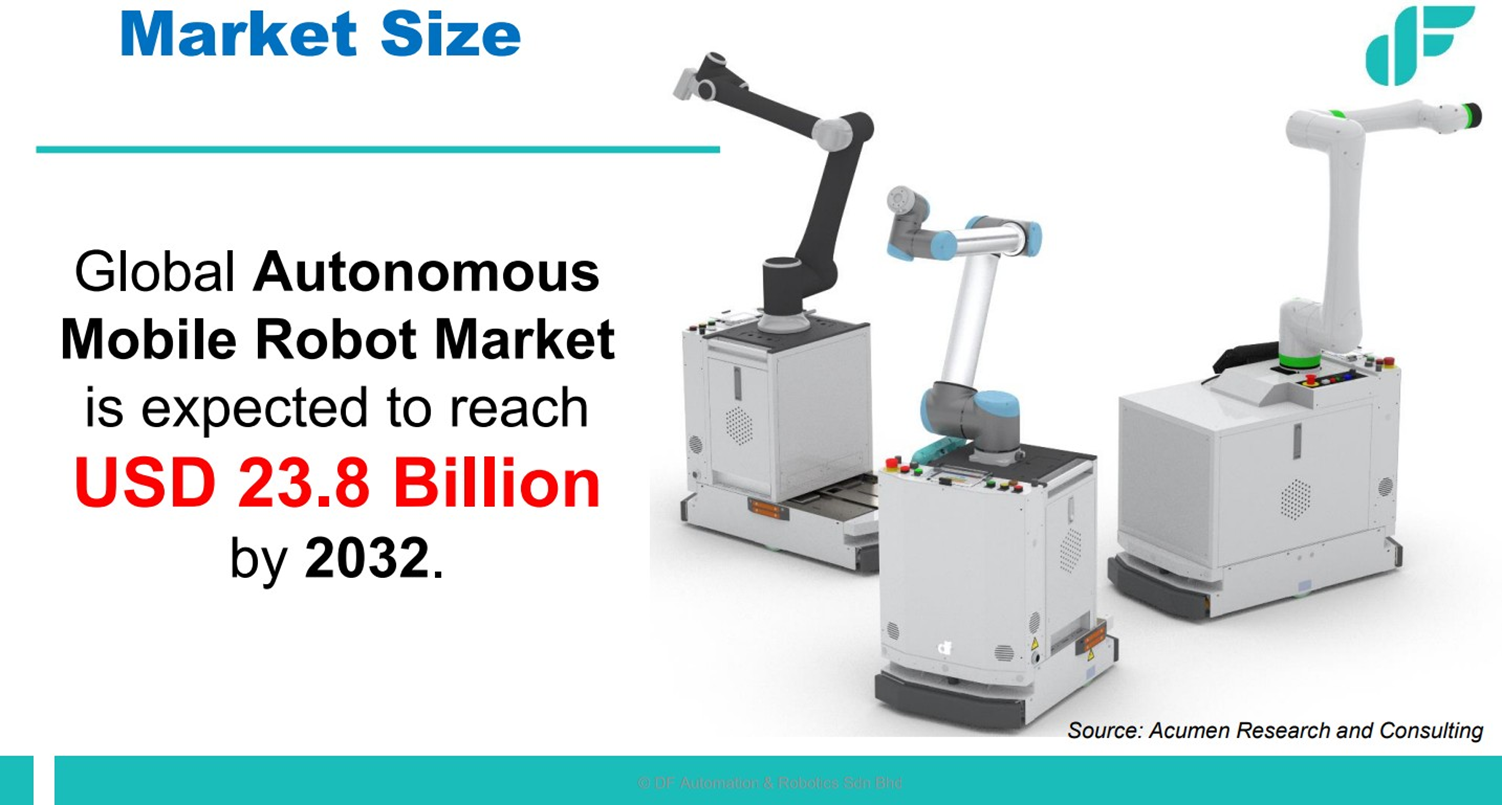

Global AMR market is expected to garner USD23.8 billion (RM 112.6 billion) by 2032. High demand for warehouse automation and rapid Industry 4.0 adoption especially from emerging countries would strategically position DF as one of the beneficiaries in the coming years.

Competition

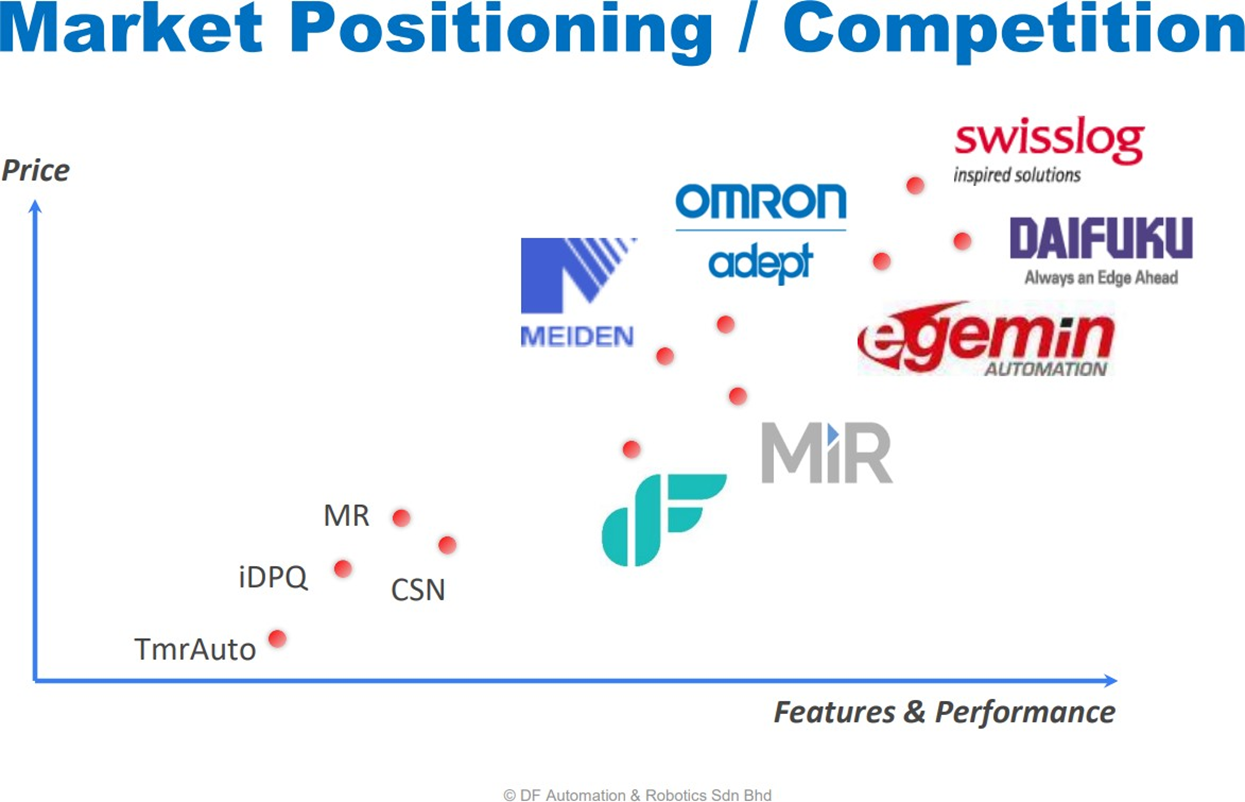

Our competitors are MiR, Omron Adept, and some China-made AMRs.

There are numerous AMR manufacturers worldwide, including those from local, China, Japan, and Europe. Each of these AMRs possesses its own strengths and weaknesses in terms of pricing, features, quality, Industry 4.0 readiness, compliances, and ease of use, among other factors. DF competes effectively with some of these AMRs. The key distinctions of DF lie in its cost effective, user-friendly interface, customization capabilities, Industry 4.0 integration, and adherence to compliances.

Funding

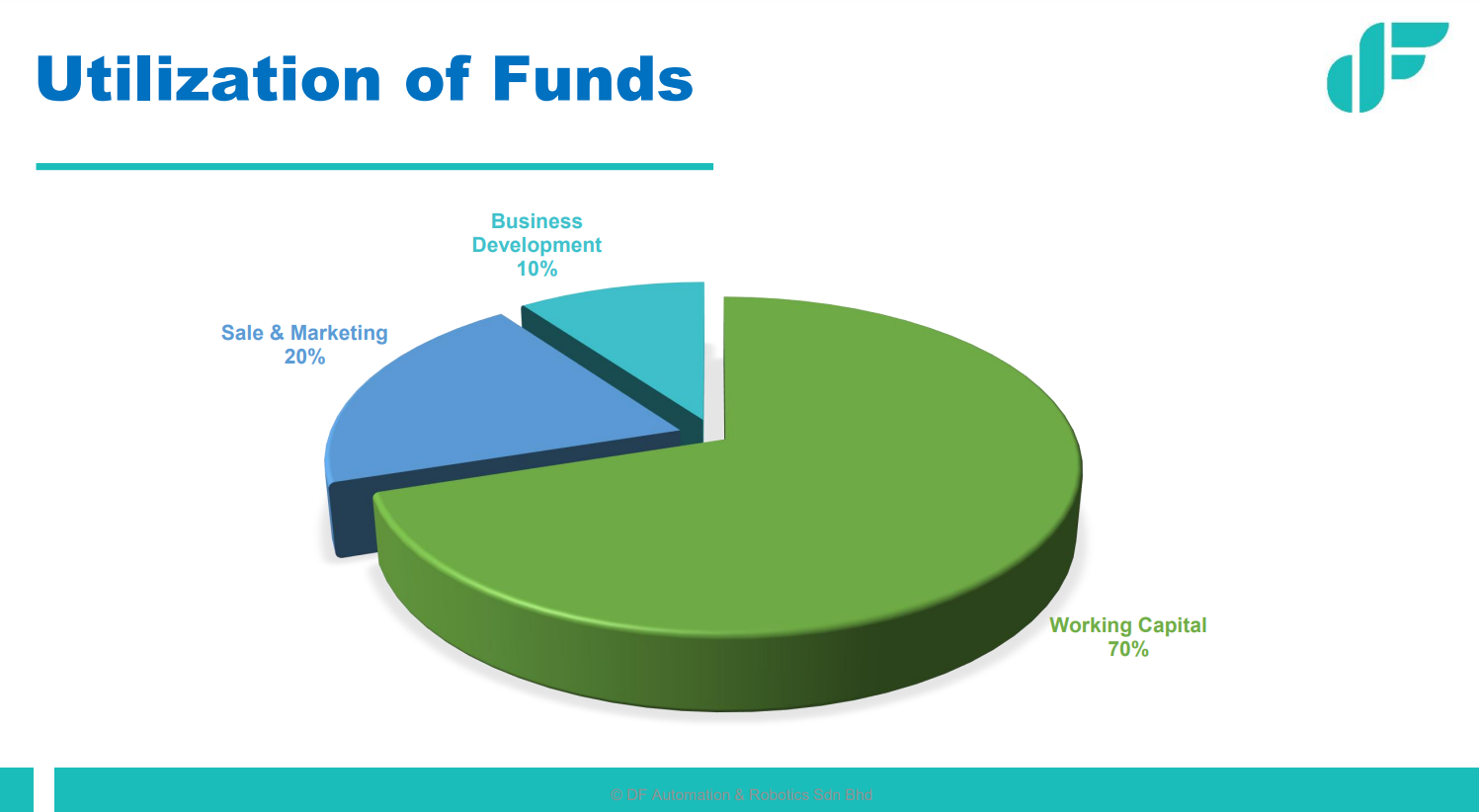

DF intends to utilize the funds to expand its operations and support additional projects. With the establishment of a new international branch in India and ongoing exploration of the European and US markets, we aim to enhance our global presence. Through penetration into these new markets, our objective is to achieve substantial growth and secure a larger market share in the years ahead.

Vision

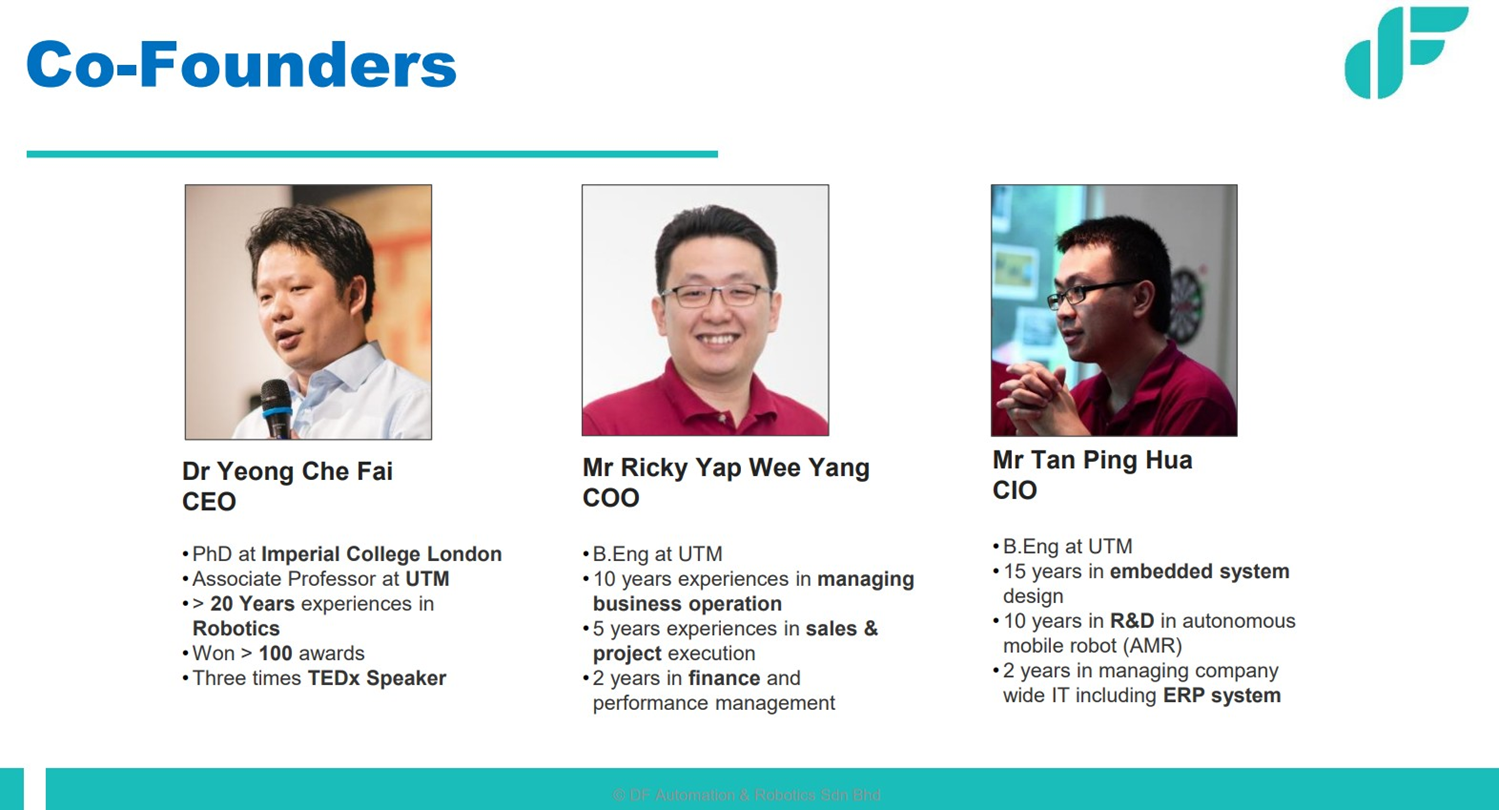

Founders

Team

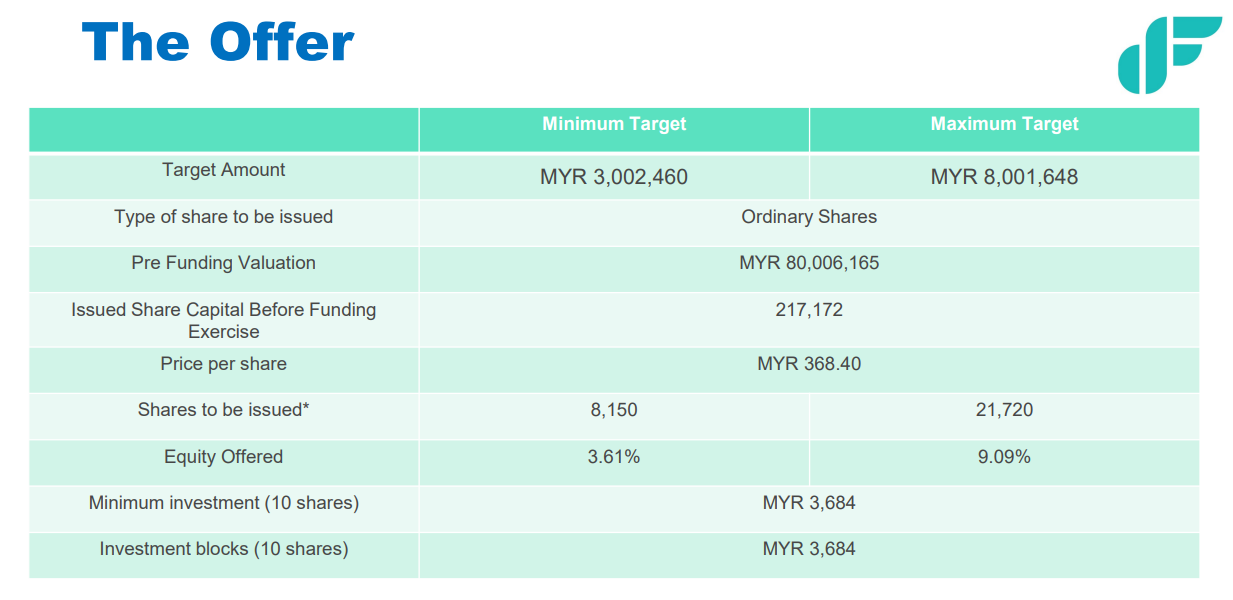

Investment Terms

DF targets to go for an initial public offering (IPO) once we hit a valuation of RM200 million. Tentatively, 2027.

In the mean time, DF is also open to mergers and acquisitions as exemplified by Teradyne acquisition of MiR (Mobile Industrial Robots) in 2018, which was valued at MYR 1.2 billion.

Disclosure

- pitchIN and its officers and staff may also be investing in this campaign

- Under ECF Guidelines, valuation is determined and set by the Issuer. Investors are advised to carefully peruse all investment offers and documents before making investment decisions.

- Equity - OS

- ~ up to 9.09%

- RM 80,006,165

- RM 3,002,460

- RM 8,001,648

- -

- DF Automation & Robotics Sdn Bhd

- 5, Jalan Impian Emas 18, Taman Impian Emas, 81300 Skudai, Johor, Malaysia.

- 1006594V